HouseCanary – AI-Powered Real Estate Valuations & Market Insights

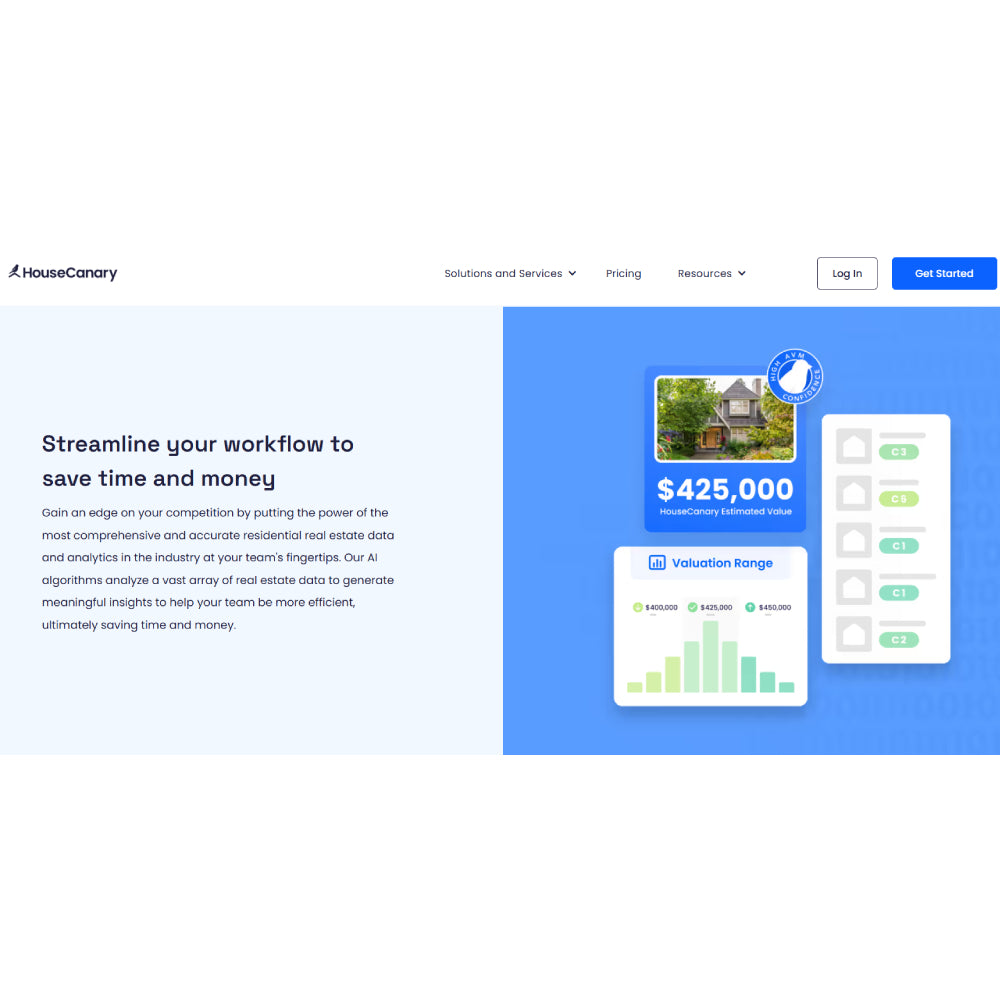

HouseCanary is an AI-powered real estate analytics platform that provides accurate property valuations, market forecasts, and investment insights across the U.S. With access to data on over 136 million properties, HouseCanary empowers real estate professionals, investors, and lenders to make informed decisions. The platform offers tools like Automated Valuation Models (AVMs), Comparative Market Analyses (CMAs), and portfolio monitoring, all delivered through a user-friendly interface. Whether you're evaluating a single-family rental or analyzing market trends, HouseCanary's comprehensive data and AI-driven insights streamline the decision-making process. The platform's predictive analytics help users anticipate market movements, identify investment opportunities, and optimize pricing strategies. Its flexible API allows for seamless integration into existing workflows, enhancing efficiency and scalability. Trusted by top real estate investors and mortgage lenders, HouseCanary is a valuable tool for anyone involved in residential real estate.