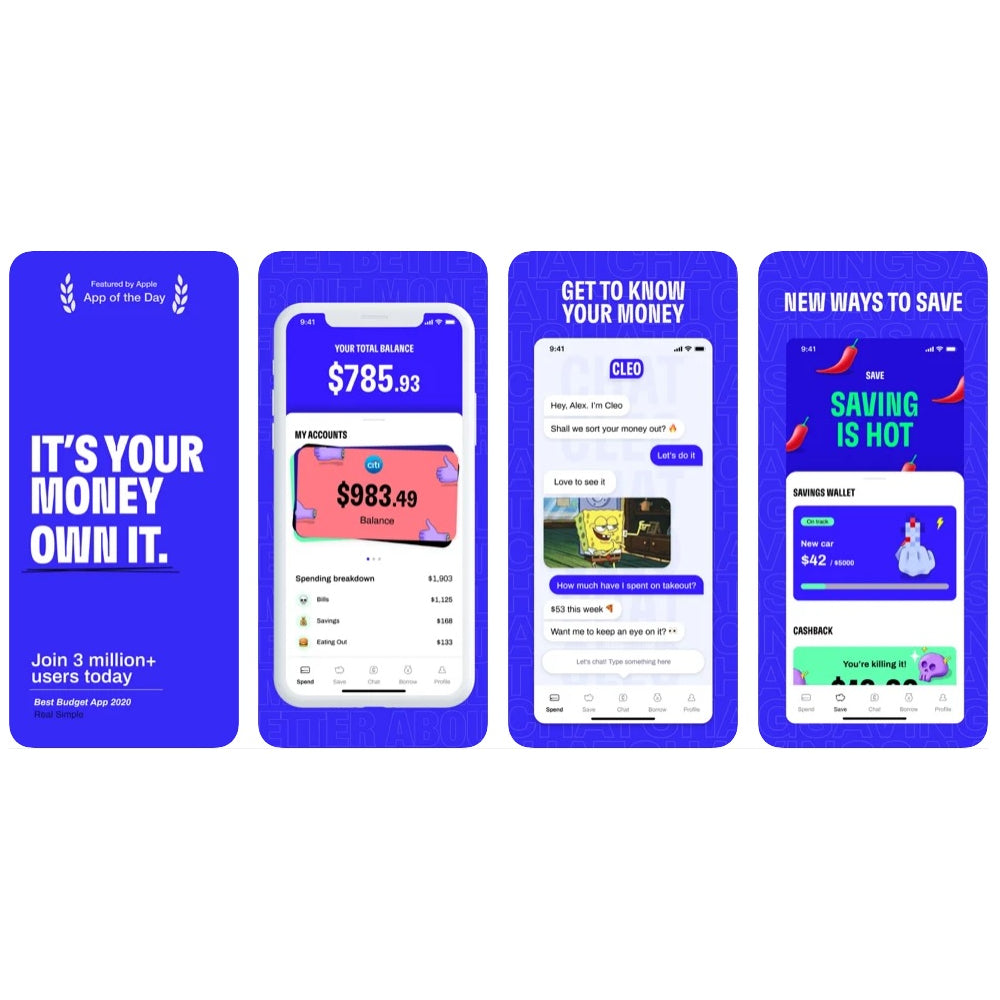

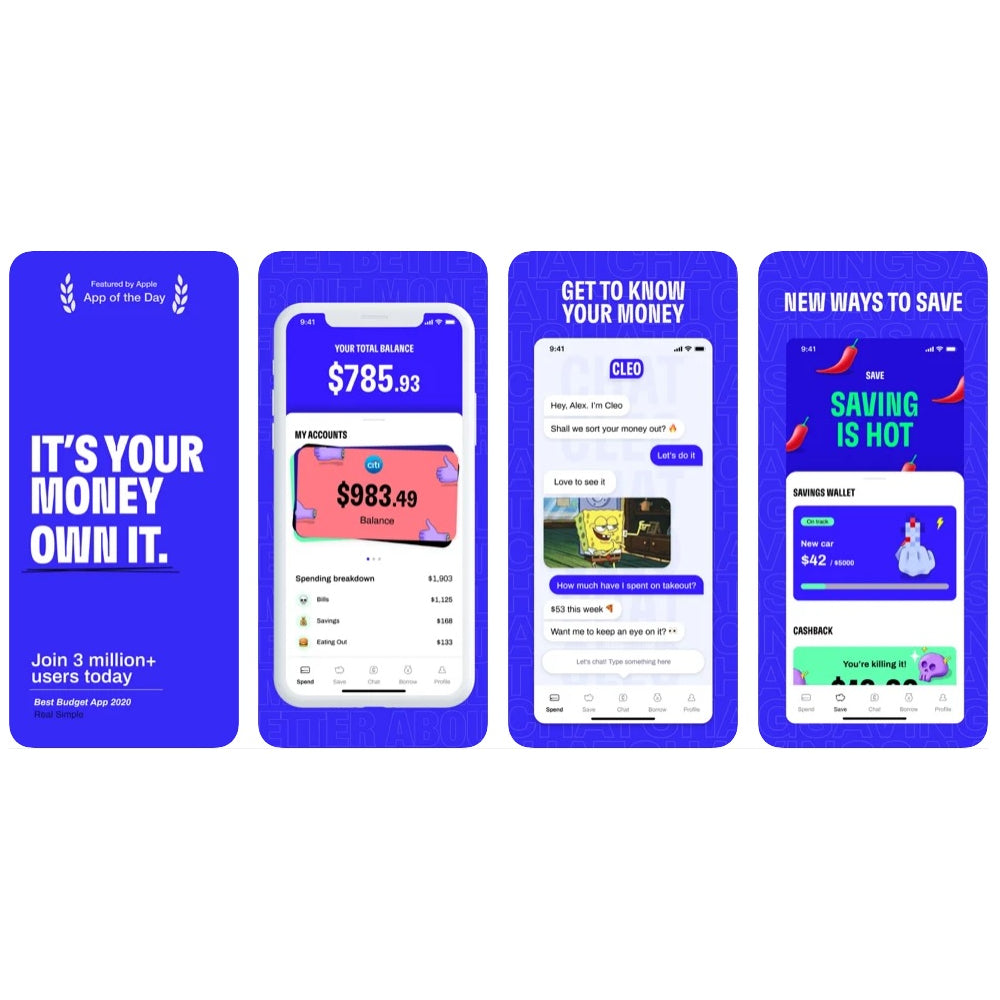

Cleo is an AI-powered personal finance assistant designed to simplify money management for users worldwide. By connecting securely to bank accounts, Cleo analyzes spending patterns, offers budgeting advice, and provides automated savings solutions. Users can benefit from tools like cash advances, bill negotiation support, and high-yield savings accounts. The friendly chatbot interface ensures that financial guidance is interactive, approachable, and easy to follow. Cleo empowers individuals to make informed decisions, save efficiently, build credit, and enhance overall financial literacy. Ideal for anyone looking to take control of personal finances, manage debt, or plan for future expenses, Cleo transforms financial planning into a seamless, AI-driven experience.

Key Features:

Conversational Interface for friendly, intuitive financial guidance

Spending Analysis to track habits and optimize savings

Budgeting Tools to create, monitor, and maintain financial goals

Automated Savings with round-ups and auto-transfers

Cash Advances up to $250 for unexpected expenses

Credit Builder Program to improve credit score efficiently

Bill Negotiation Assistance to reduce monthly expenses

Access to High-Yield Savings Accounts for better returns

Industries:

Personal Finance

FinTech

Banking & Credit Management

Wealth Management

Digital Financial Services