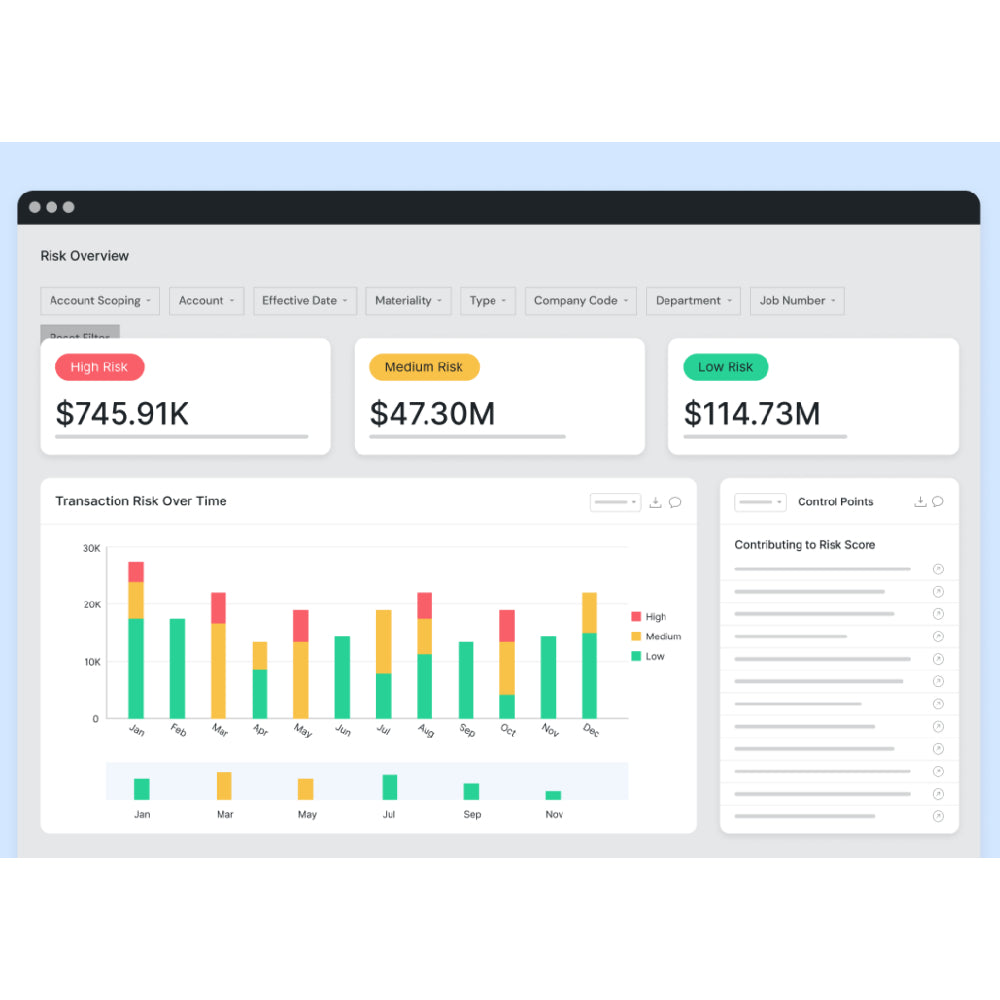

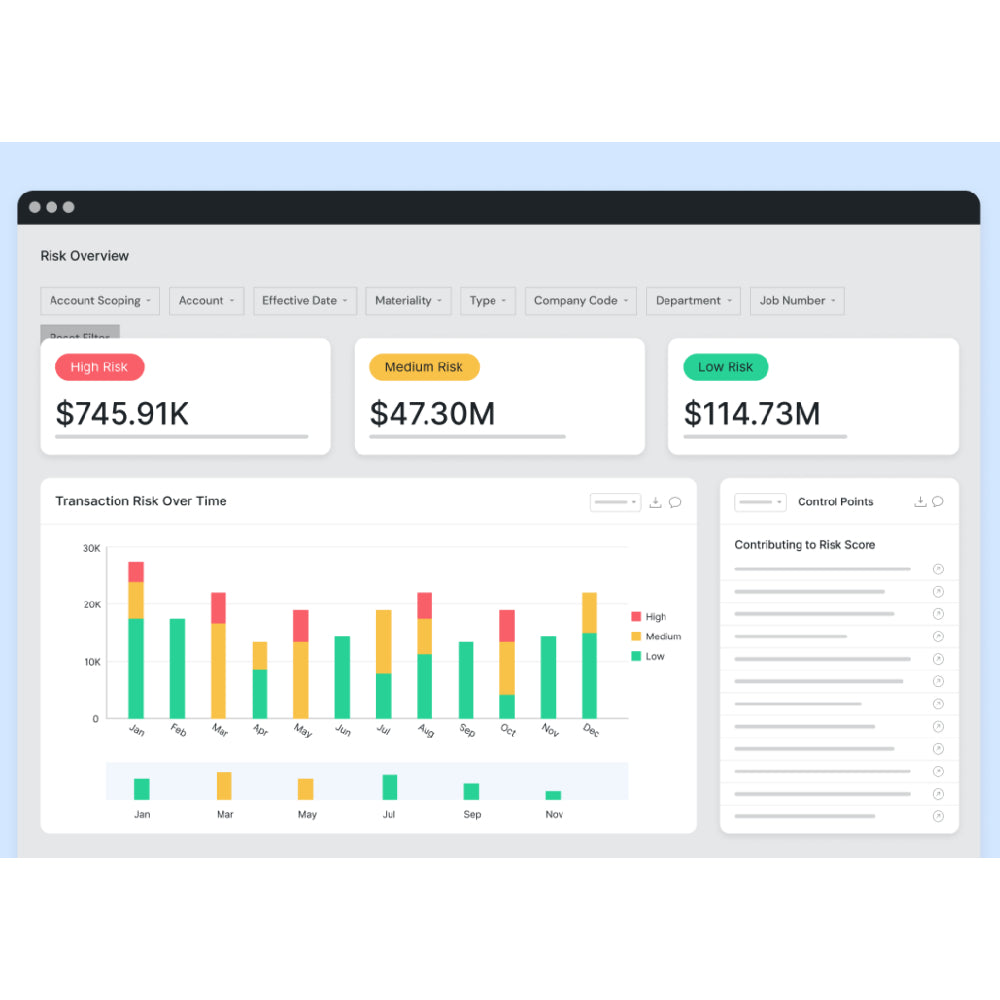

MindBridge is revolutionizing auditing, compliance, and financial risk management through AI-powered transaction analysis. Unlike traditional auditing methods that rely on sampling, MindBridge evaluates all financial transactions to ensure accuracy, visibility, and control. Its machine learning algorithms detect unusual patterns, anomalies, and potential fraud while assigning intelligent risk scores to prioritize high-risk areas. Designed to integrate with major ERP systems like SAP, Oracle, and Microsoft Dynamics, MindBridge ensures smooth and reliable data access. With continuous monitoring, predictive insights, and automated reporting, it enhances audit efficiency, compliance adherence, and financial decision-making. By modernizing auditing processes, MindBridge empowers organizations to achieve greater transparency, control, and resilience.

Key Features

Comprehensive analysis of all financial transactions for complete oversight

Machine learning and statistical anomaly detection for fraud prevention

Intelligent risk scoring system to prioritize focus areas

Continuous monitoring with real-time financial risk insights

Seamless integration with ERP systems (SAP, Oracle, Microsoft Dynamics)

User-friendly dashboards for clear insights and reporting

Automated reports on anomalies, risks, and financial trends

Industries

Financial Services

Public Accounting Firms

Government & Public Sector

Healthcare & Pharmaceuticals

Manufacturing & Enterprises

Audit & Compliance Firms