TL;DR

Finance teams in 2025 are moving beyond spreadsheets and embracing automation.

AI is now the driving force behind faster audits, more accurate forecasting, and efficient reporting.

The new era of financial management is intelligent, data-driven, and fully automated.

What, Why, and How The Rise of AI in Finance

What is AI in Finance

AI in finance uses smart algorithms and automation tools to perform repetitive or complex financial tasks that once required human effort.

These systems learn from data and continuously improve accuracy, turning numbers into real insights.

From compliance monitoring to transaction auditing, AI has become the digital backbone of finance operations.

Why Finance Needs AI Now

Finance departments handle thousands of transactions daily. Manual reviews slow everything down and increase the risk of human error.

AI solves this by automating reviews, catching errors instantly, and helping teams stay compliant.

AI helps finance teams by:

-

Auditing every transaction instantly

-

Detecting fraud and duplicate payments

-

Reducing close cycles from days to hours

-

Maintaining VAT and IFRS compliance

-

Providing real-time dashboards for decision-making

In fast-growing economies like the UAE, where corporate tax and VAT compliance are critical, AI in finance is essential for efficiency and governance.

How AI Transforms Finance Operations

AI connects with ERP and accounting systems to eliminate manual work.

Instead of checking invoices or closing books manually, finance teams use AI to:

-

Validate transactions automatically

-

Predict payment patterns and cash flow

-

Reconcile multi-entity accounts in real time

-

Generate audit-ready reports within minutes

The result is higher accuracy, lower risk, and more time for strategy and forecasting.

5 AI Tools for Finance to Try in 2025

Here are the five tools that are transforming finance and accounting across industries and the UAE.

AppZen – Best for AI-driven expense auditing and compliance

HighRadius – Best for cash forecasting and receivables automation

BlackLine – Best for faster financial closing

Workiva – Best for connected reporting and compliance tracking

DataSnipper – Best for AI audit automation directly inside Excel

Let’s look at what makes each one powerful.

AppZen Smarter Auditing and Better Compliance

Description

AppZen is an AI-powered auditing platform that reviews 100 percent of financial transactions automatically.

It flags duplicate expenses, policy violations, and fraudulent claims in real time.

AppZen supports VAT and corporate tax compliance for UAE and international organizations, making it ideal for large enterprises.

It integrates easily with major ERP systems, giving teams faster, more accurate audits.

Use Cases

-

Real-time expense and invoice auditing

-

Fraud and duplicate claim detection

-

Compliance checks for VAT and tax policies

-

Automated approval workflows

Pros

-

Automates full audit cycles

-

Detects anomalies instantly

-

Strengthens compliance and reduces manual work

Cons

-

Requires initial data setup and integration

-

Best suited for enterprise use

Pricing

Custom pricing based on transaction volume and system integrations

Now available on Daidu.ai Try AppZen today

HighRadius Predictive Cash Flow and Receivables Automation

Description

HighRadius automates treasury and receivables processes using predictive AI.

It forecasts payments, improves collections, and optimizes working capital with precision.

The system connects with ERP platforms like SAP, Oracle, and Microsoft Dynamics, offering real-time cash insights.

Finance leaders use it to maintain liquidity, improve accuracy, and drive smarter cash decisions.

Use Cases

-

Predict customer payment behavior

-

Automate cash application and dispute management

-

Generate real-time cash flow forecasts

-

Optimize liquidity and working capital

Pros

-

Accurate forecasting powered by AI

-

Integrates easily with ERP systems

-

Enhances cash visibility across departments

Cons

-

Requires structured data for optimal accuracy

-

Advanced modules have additional costs

Pricing

Enterprise pricing based on modules and data size

Now available on Daidu.ai Try HighRadius today

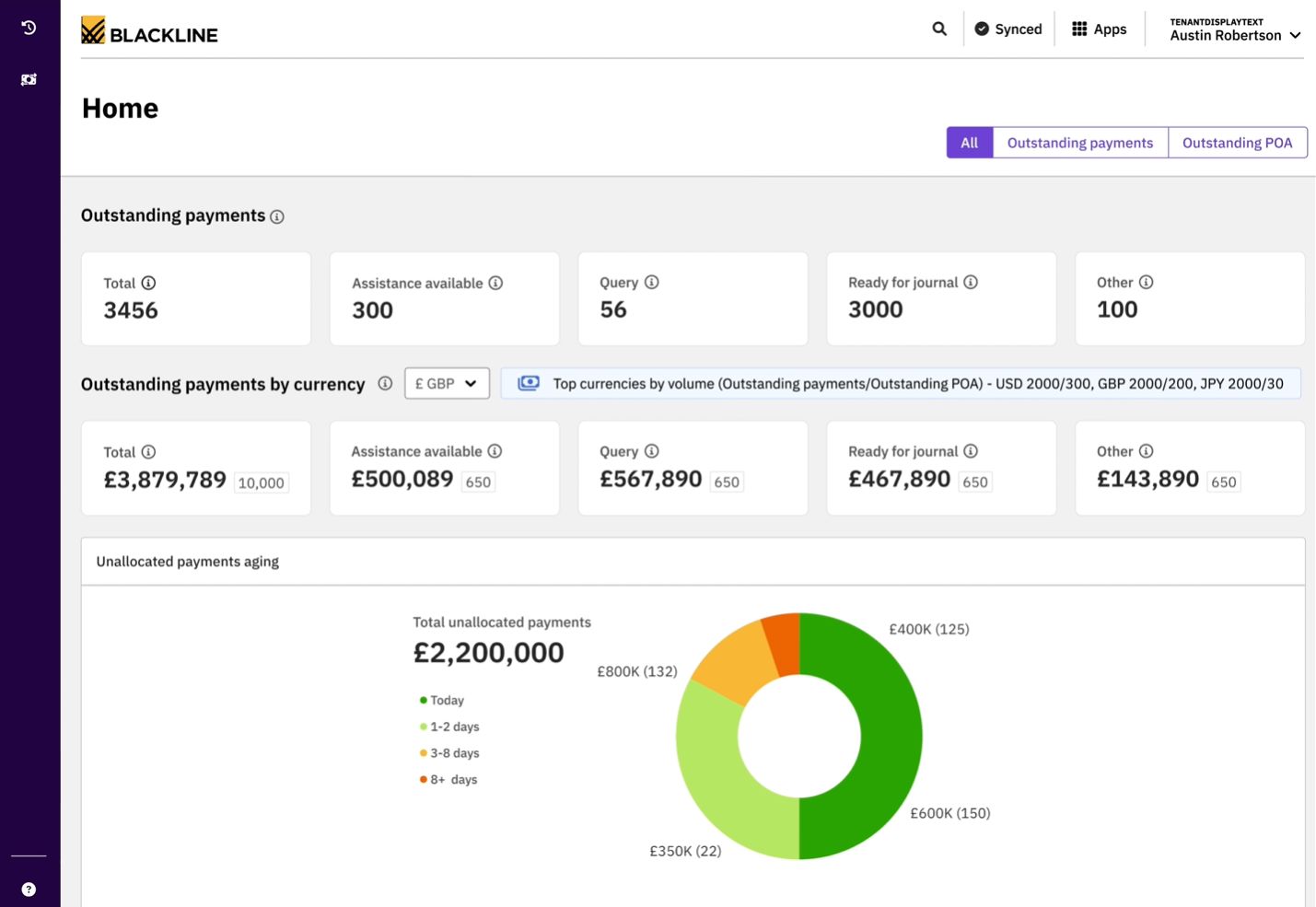

BlackLine Automated Financial Close and Reconciliation

Description

BlackLine automates reconciliations, journal entries, and close cycles to replace traditional spreadsheet-based workflows.

It monitors every transaction, identifies errors instantly, and keeps companies audit-ready at all times.

BlackLine supports IFRS compliance and is perfect for UAE companies managing multiple subsidiaries.

Use Cases

-

Automate monthly and quarterly closing

-

Detect mismatched or missing entries

-

Standardize intercompany transactions

-

Generate audit-ready reports automatically

Pros

-

Cuts close time by up to 70 percent

-

Reduces accounting errors

-

Strengthens audit control and transparency

Cons

-

Requires user training for complex setups

-

Pricing scales with company size

Pricing

Custom pricing depending on the number of users and subsidiaries

Now available on Daidu.ai Try BlackLine today

Workiva Unified Reporting and Compliance Made Simple

Description

Workiva connects people, data, and reports in one AI-powered workspace.

It automates financial, ESG, and compliance reporting while tracking all document versions.

Teams can collaborate in real time and validate every number automatically.

For UAE-based companies, Workiva simplifies IFRS, ESG, and sustainability reporting requirements.

Use Cases

-

Create and manage financial and ESG reports

-

Track compliance documentation

-

Collaborate across departments

-

Validate data automatically before submission

Pros

-

Connects all reports in one workspace

-

Real-time collaboration across teams

-

Simplifies audit tracking and approvals

Cons

-

Complex for smaller teams

-

Advanced modules may add cost

Pricing

Custom pricing based on compliance needs and report complexity

Now available on Daidu.ai Try Workiva today

DataSnipper AI Audit Automation Inside Excel

Description

DataSnipper is a lightweight AI tool built directly inside Excel.

It automates document verification, cross-referencing, and testing during audits.

It links data sources and provides full traceability for every audit step.

Perfect for firms that want automation without switching platforms.

Use Cases

-

Automate cross-referencing for audits

-

Verify supporting evidence instantly

-

Accelerate compliance testing

-

Improve accuracy and reduce review time

Pros

-

Works seamlessly within Excel

-

Reduces audit time by up to 70 percent

-

Improves accuracy and documentation quality

Cons

-

Limited features outside Excel

-

Advanced reporting requires enterprise plan

Pricing

Subscription-based with enterprise options for large firms

Now available on Daidu.ai Try DataSnipper today

Final Takeaway

The financial industry is entering a new era where automation equals efficiency.

AppZen, HighRadius, BlackLine, Workiva, and DataSnipper are redefining how finance teams audit, forecast, and report.

These tools reduce risk, speed up decision-making, and give finance leaders the confidence to manage data intelligently.

Automate smarter, forecast faster, and grow stronger with AI for finance. Explore all tools now at Daidu.ai.

FAQs

Q1. What are the best AI tools for finance in 2025

AppZen, HighRadius, BlackLine, Workiva, and DataSnipper are the top five tools that automate audits, forecasting, and reporting.

Q2. How can AI improve financial accuracy

AI reviews every transaction in real time, detects inconsistencies, and ensures full compliance faster than manual processes.

Q3. Are these tools suitable for UAE companies

Yes. They support IFRS, VAT, and corporate tax compliance and are ideal for UAE and GCC enterprises.

Q4. What is the biggest benefit of using AI in finance

AI increases efficiency, reduces manual effort, shortens closing cycles, and enhances data accuracy.

Q5. Where can I find these AI finance tools

All tools are available on Daidu.ai, the number one marketplace for discovering and integrating AI solutions for businesses.